retained earnings debit or credit

According to generally accepted accounting principals GAAP increases to the retained earnings account on the balance sheet are reflected with a credit entry. Retained Earnings 10000 x 20 200000.

Debits And Credits Summary Ppt Video Online Download

As the name suggests retained earnings represents income that was retained ie kept accumulated by the company.

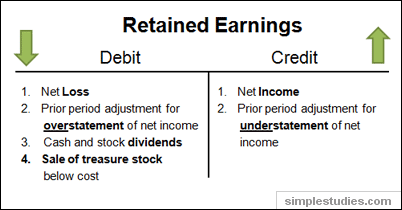

. On the companys balance sheet negative retained earnings are usually described in a separate line item as an Accumulated Deficit. In most cases retained earnings has a credit balance receiving a credit when it increases and a debit when it decreases. What type of account is retained earnings debit or credit.

This means that if you want to increase the retained earnings account you will make a credit journal entry. On January 1 the Christopher Corporation reported assets of 20000 liabilities of 12000 common stock of 5000 and retained earnings of 3000. How is retained earnings treated in accounting.

Debit to retained earnings. Consequently the amount of the credit balance does. Click to see full answer.

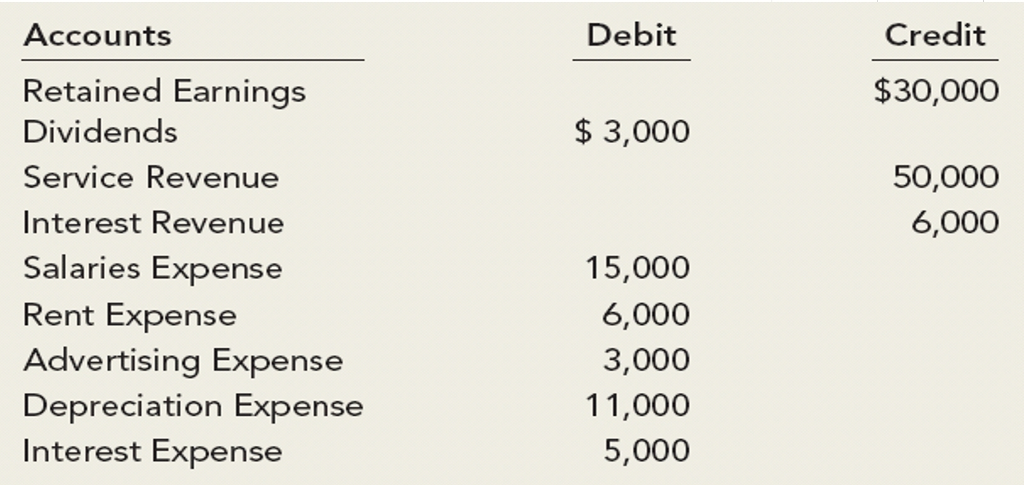

The normal balance in retained earnings is credit. It is the declaration of cash dividends that reduces Retained Earnings. The debit balance values will be listed in the debit column of the trial balance and the credit value balance will be listed in the credit column.

Normally these funds are used for working capital and fixed asset purchases capital expenditures or allotted for paying off debt obligations. However the amount of the retained earnings balance could be relatively low even for a financially healthy company since dividends are paid out from this account. C On May 1 a business provided legal services to a client and billed the client 4000.

Some instances which reduce the balance of retained earnings are-. Subsequently one may also ask what type of account is distributions. Hence the retained earnings account will increase credit or decrease debit by the amount of net income or net loss after the journal entry.

When the company actually pays the dividends to shareholders the dividends-payable account is debited and cash is credited. Retained Earnings are credited with the Net Profit earned during the current period. Common Stock Dividend Payable.

This indicates that Smith Company. The normal balance in the retained earnings account is a credit. Retained earnings are reported on the liability side of the balance sheet at the end of accounting period.

Negative retained earnings appear as a debit balance in the retained earnings account rather than the credit balance that normally appears for a profitable company. What are possible transactions that can affect retained earnings account. This balance signifies that a business has generated an aggregate profit over its life.

Typically you would not change the amount recorded in your retained earnings unless you are adjusting a previous accounting error. A debit balance in the retained earnings account is called a deficit. On the other hand the credit impact of the transaction is a decrease in the cash balance.

Crediting the retained earnings. When dividends are declared by a corporations board of directors a journal entry is made on the declaration date to debit Retained Earnings and credit the current liability Dividends Payable. That is retained earnings increase when credited and decrease when debited.

In other words an RE deficit is a negative retained earnings account. However it is possible that a business distributes more to its owners than it earns and ends up with negative retained earnings with a debit balance. This balance signifies that a business has generated an aggregate profit over its life.

A debit journal entry will decrease this account. If the corporation suffered a net loss Retained Earnings will be debited. The normal balance in the retained earnings account is a credit.

The journal entries made with the declaration of dividends include a debit to the retained-earnings account and a credit to the dividend-payable account. When is Retained Earnings credited or debited. Smith Companys journal shows a debit to cash and a credit to notes payable both for 15000.

Summary of all the debits and credits made during the period. Retained earnings are an equity account and appear as a credit balance. Dr Retained earnings Cr Sales.

For example company A which is a trading company has a net income of 25000 which all of its respective income and expenses have already been transferred to the income summary account at the end of 2020. This means the corporation has incurred more losses in its existence than profits. D Debit Retained Earnings for 44900 and credit Equipment for 44900.

The debit impact of the transaction is a decrease of retained earning as profitretained earning has been paid to the shareholders. The ending retained earnings balance from the statement of retained earnings will tie to the balance sheet and the balance sheet will balance. Retained Earnings RE are the accumulated portion of a businesss profits that are not distributed as dividends to shareholders but instead are reserved for reinvestment back into the business.

Cash or scrip dividends. A retained earnings balance is increased when using a credit and decreased with a debit. Your companys net income or loss minus your shareholders dividends is your retained earnings.

A retained earnings deficit also called an accumulated deficit happens when cumulative losses are greater than cumulative profits causing the account to have a negative or debit balance. Accounting Treatment of Retained Earnings. The normal balance of a retained earnings account is a credit as it signifies the accumulations of a.

Debit to cash D. Negative retained earnings on the other hand appear as a debit balance. If you need to reduce your stated retained earnings then you debit the earnings.

The normal balance in the retained earnings account is a credit. Debits Credits. Given entry is posted in the accounting system when the dividend is paid.

Paid-in Capital in Excess of Par. Decreases to returned earnings as might be found with a net loss are accounted for with a debit entry into the accounting journal. Are Retained Earnings a Debit or Credit.

Corporations Earnings And Distributions Ppt Download

Debits And Credits In The Accounts Accounting Basics

What Are Retained Earnings Accounting Question Answer Q A Simplestudies Com

3 2 Explain How Accounts Debits And Credits Are Used To Record Transactions Flashcards Quizlet

Solved Accounts Debit Credit Retained Earnings Dividends Chegg Com

Debits And Credits Site Economics

Solved What Is The Income Summary Debit And Retained Chegg Com

0 Response to "retained earnings debit or credit"

Post a Comment