pay hmrc by phone

Call HMRC for general advice on how to pay Self Assessment. Payments made by Faster Payments online or telephone banking will usually reach HMRC on the same or next day.

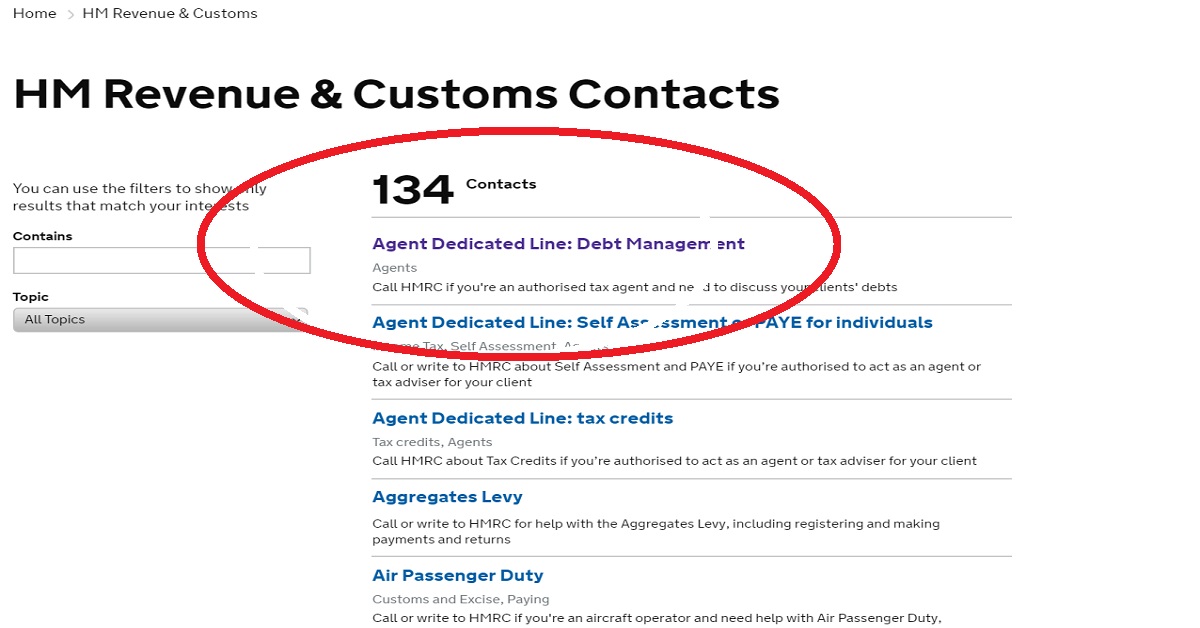

Hmrc Customer Service Contact Numbers Tax Helpline 0300 200 3300

If you cannot use speech recognition software find out.

. 0300 200 3835 Monday to Friday. Online debit and credit card payment support. If you press 1 and fall victim to the.

Can I ask my employer to change my tax code. Breaking to the American market. During the conversation you will be given a story as to why you need to send funds immediately - maybe a former employer has messed up your tax code or youre told that youve been evading tax payments.

To contact HMRC about your tax credits please phone their dedicated tax credit helpline 0345 300 3900. Moreover you can easily even out your liquidity and avoid applying for new loans to pay your tax bill. You can also find out information in.

CHAPS payments usually reach HMRC the same working day if you pay within your banks. However right until 1986 the company achieved certainly one of its main objectives. Why have HMRC changed my tax code.

To write to HMRC about child benefits send your letter to HM Revenue and Customs Child Benefit Office PO Box 1 Newcastle Upon Tyne NE88 1AA. How do I contact HMRC by phone. If youve not had any contact from HMRC then call the Payment Support Service.

You earn loyalty reward and bonus points. But you cannot pay your bill during a conversation with an HMRC advisor. HMRC online services helpdesk.

Youll need your Self Assessment Unique Taxpayer Reference UTR when you call. There is a phone number to call if you have an urgent question about your VAT. Child benefits helpline 0300 200 3100.

You can apply for your UTR number by calling HMRC directly on 0300 200 3310. What do we pay tax for UK. HM Revenue and Customs regulate and monitor tax payments from across the UK.

You cannot make payments using this. Hmrc Pay Paye By Phone Hmrc Pay Paye By Phone - In the course of the 1980s Hyundai observed rapid growth producing major inroads into global marketplaces. As a result of rigorous emissions polices but Hyundai quickly rose into the occasion.

0300 200 3300 - Call the HMRC Contact Number for Help with Child Benefit PAYE Income Tax VAT Self Assessment Tax Credits and More. HMRC will post your UTR number within seven days. Pay via the CHAPS system using the account details above.

Our phone line opening hours are. Lines are open Monday to Friday 8am to 6pm. Time your call right.

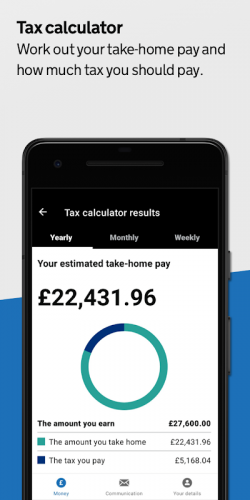

Youll usually have the option to contact HMRC through an online form webchat by phone or by post. With Billhop you can pay your HMRC tax bill using personal or corporate credit cards from any card issuer. Not only is Billhop an easy way to pay HMRC or any other bill but you also take advantage of all the benefits of using a credit card.

Callers outside the UK should call 44 161 210 3086. You can call this phone number to find out how much you will get paid when your tax credits payment will be made and to inform HMRC about a change in your circumstances which will affect your tax credits such as a change in income. How Do I Apply For My UTR Number By Phone.

If youre calling from abroad the number is 44 2920 501 261. Any calls or texts can appear to come from a phone number linked to HMRC law enforcement or the courts - this is known as phone number spoofing. While 125000 sounds like a huge number and a.

If we are going to speak about PAYE tax we should first explain HMRC because they are the enforcer of Income tax. Closed on weekends and bank holidays. Payment Support Service Telephone.

Your card often has a 30-45 day interest free payment period. During the call HMRC may ask you about your details and your national insurance number to validate your identity. Is the tax code changing in April 2020 UK.

Find out how to get help from HMRC if you need extra support for example if you need. Even if you realise that it is a scam and hang up before giving the scammers any information because the call may be routed to a different country you could get a costly phone bill. 0300 200 3300 - An Unofficial Resource Providing a Call Connection Service for HMRC.

The time of day you call HMRC can have a big impact on how long you wait to speak to. 0300 200 3822 Tax liabilities. Use Billhop to pay all forms of HMRC bills VAT Income tax Corporation tax Self assessment tax Stamp duty land tax Employers PAYE and National Insurance Why pay your tax with Billhop.

Why has my tax code been reduced. No you cant ring up HMRC and pay your tax bill over the phone but you can use your banks telephone banking service. Pay online via telephone banking or BACS using the following account details you will need your 9-digit VAT registration number.

You can find more relevant numbers on the contact HMRC page. They are required to pay one per cent of the rent value as an annual tax. For all general enquires regarding the PAYE system tax codes paying income tax and more contact HMRC PAYE using the telephone number above.

Pay HMRC by direct debit using internet or over the phone pay online and pay by cheque for your corporation tax VAT and income tax. HMRC Sign-in and Payment screen You get the option Do you want to sign in to your tax account Choose No continue to payment options if you only want to pay. Does a higher tax code mean I pay less tax.

To send payment send to HMRC Direct BX5 5BD. Self Assessment Payment Helpline Telephone. What happens if my tax code changes mid year.

Paying HRMC by credit card you extend. It is highly likely that the scammer will request a payment or personal information such as bank details to avoid the problem with your HMRC account.

Hmrc 13 2 0 Download Android Apk Aptoide

Self Assessment Tax Return And Payments Inniaccounts

Gov Uk Payment Pages Gov Uk Pay

Cheque Payments To Become Quicker And Easier Gov Uk

How To Register For Paye Mazuma

Pay Your Self Assessment Tax Bill Gov Uk

0 Response to "pay hmrc by phone"

Post a Comment